11 dollars an hour 40 hours a week after taxes

30 an hour before taxes is equal to 225 an hour after taxes. 11 an hour multiplied by 175 hours per month is 1925 per month income on average.

I Make 800 A Week How Much Will That Be After Taxes Quora

Now you only need to multiply 2080 hours for 13 an hour and you get 27040 a year.

. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 11 hourly wage is. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. By deducting a 25 tax rate from the 25 hourly rate you will find your after-tax hourly rate is 625 less than your pre-tax rate.

Comparison Table Of 13 An Hour. If you work full-time every two weeks you would make 3200 before taxes. Use this easy calculator to convert an hourly wage to its equivalent as an annual salary.

If you are paid 60000 a year then divide that by 12 to get 5000 per month. Youd multiply 27 by 40 hours and two weeks to calculate how much you make biweekly before taxes. Search for jobs related to 12 dollars an hour 40 hours a week after taxes or hire on the worlds largest freelancing marketplace with 21m jobs.

In the equation the 30 stands for 30 dollars an hour 40 means 40 hours a week and 52 stands for 52 weeks in a year. 2096 hours a year divided by 12 is about 175 working hours per month on average. How much is 30 dollars an hour per month.

To calculate how much you make biweekly before taxes you would multiply 11 by 40 hours and 2 weeks. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. This is your average gross income every week if you make 10 an hour weekly.

Weekly salary 60000. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 11 hourly wage is about 22000 per year or 1833 a month.

If your are just looking for a ballpark estimate here is how I do it. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. This calculator is intended for use by US.

Keep in mind some months have 4 weeks and some have 5 wks and I get paid bi-weekly not semi monthly. Overtime is the time worked after the limit of the 40 hours per week. Making 40 dollars an hour is good pay.

See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. In the Weekly hours field enter the number of hours you do each week excluding any overtime. If you work 20 hours per week for 52 weeks you would earn 280 per week for a total of 14560 per year.

For example say you get paid every two weeks. On the other end of that spectrum if you work 35 hours a week which is still technically part-time you would make 490 per week or 25480 a year. If you do any overtime enter the number of hours you do each month and the rate you get.

If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by 2000 to get the annual total then divide by 12 to get the monthly equivalent. 7 rows 13 an hour multiplied by 40 hours per week is 520 per week income. After taxes youd earn 1620 if you paid a tax rate of about 25 and worked full-time at 40 hours per week.

Before and After Taxes You earn 27040 a year after working 40 hours a week for 13hour before taxes. Convert 11 dollars an hour to yearly salary. For example if you did 10 extra hours each month at time-and-a-half you would enter 10.

If you work part-time 40 dollars an hour 20 hours a week you would earn 1600 before taxes. If you work 40-hours a week at 30 an hour youll gross. More information about the calculations performed is available on the about page.

The more hours you work the more money you will end up making at this hourly rate. Adding those extra work hours or tips can drastically. An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings.

His income will be. This averages out to a bi-weekly salary of 1920 after taxes. 30 an hour 40 hours a week is 2440 every 2 weeks before taxes.

Before taxes 2160 per hour is 2160 and after taxes its about 1620. So on the top end you would take. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. If you work 25 hours a week at 30 an hour youll gross 1500 every 2 weeks and take home around 1270. Likewise 36 plus 48 is 84 hours which becomes 42 after dividing by 2.

So to calculate your monthly income see below. In this case you would make a 40 hours x 52 weeks operation which gives you 2080 hours a year. If I have health insurance and other benefits withheld I always figure I will take home about 6065 If I just have basic deductions I figure I will take home about 70.

For people with alternating work schedules like doctors or nurses to calculate their average hours they would add 2 weeks together then divide by 2. 10hour is in the bottom 10 of wages in the United States. If we divide the total working hours in a year by 12 months we can see how many working hours are in a month.

Is 13 an hour good pay. People working overtime taking on extra work or receiving tips need to add them to the total number. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Hourly wage 2500 Daily wage 20000 Scenario 1. Enter your hourly wage - the amount of money you are paid each. To calculate how much you make biweekly before taxes you would multiply 40 by 40 hours and 2 weeks.

So for example 3 days plus 4 days is 7 days which divided by 2 is 35 days in their average work week. Most often used overtime multiplier is one and a half of the regular pay rate but it can be agreed between the employee and the employer. Earn 14hr 22hr teaching English.

It can also be used to help fill steps 3 and 4 of a W-4 form. His income will be. If I make 1150 an hour working full time 40 hours a week how much money do i make a year after deducting 60 dollars of taxes from my pay check every month.

14 dollars annually part-time is between 14560 and 25480. The following table lists flat monthly incomes based on a 2000 hour work year. The typical work day consists in 8 hours while the working week is around 40 labour hours.

Is 11 an hour good pay. Answer 1 of 8. Its free to sign up and bid on jobs.

The double time is calculated as the normal.

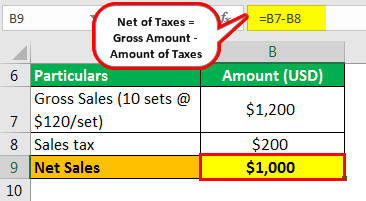

Net Of Taxes Meaning Formula Calculation With Example

2022 2023 Tax Brackets Rates For Each Income Level

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

Net Of Taxes Meaning Formula Calculation With Example

Paycheck Taxes Federal State Local Withholding H R Block

Missouri Income Tax Rate And Brackets H R Block

How Much Do I Need To Make Hourly To Take Home 1 000 After Taxes Weekly Quora

Here S How Much Money You Take Home From A 75 000 Salary

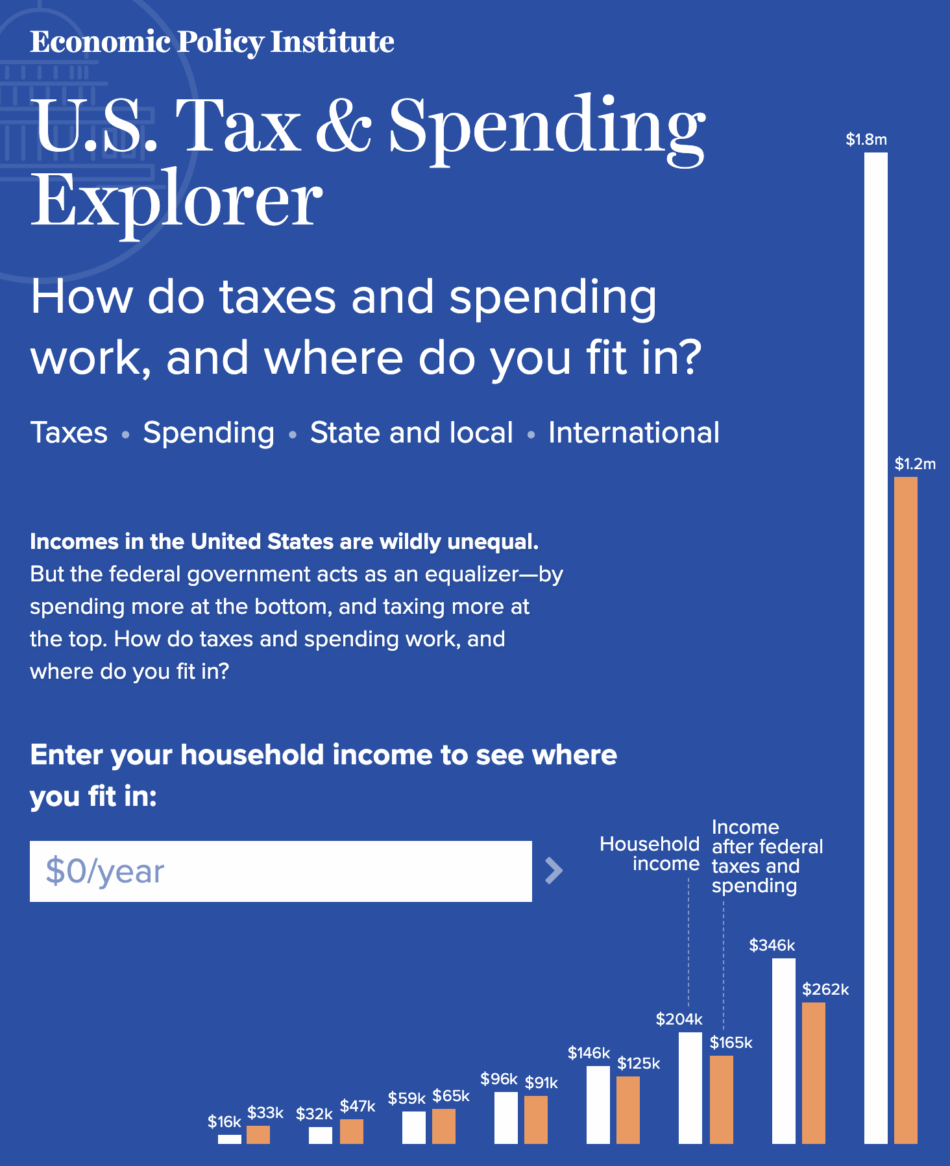

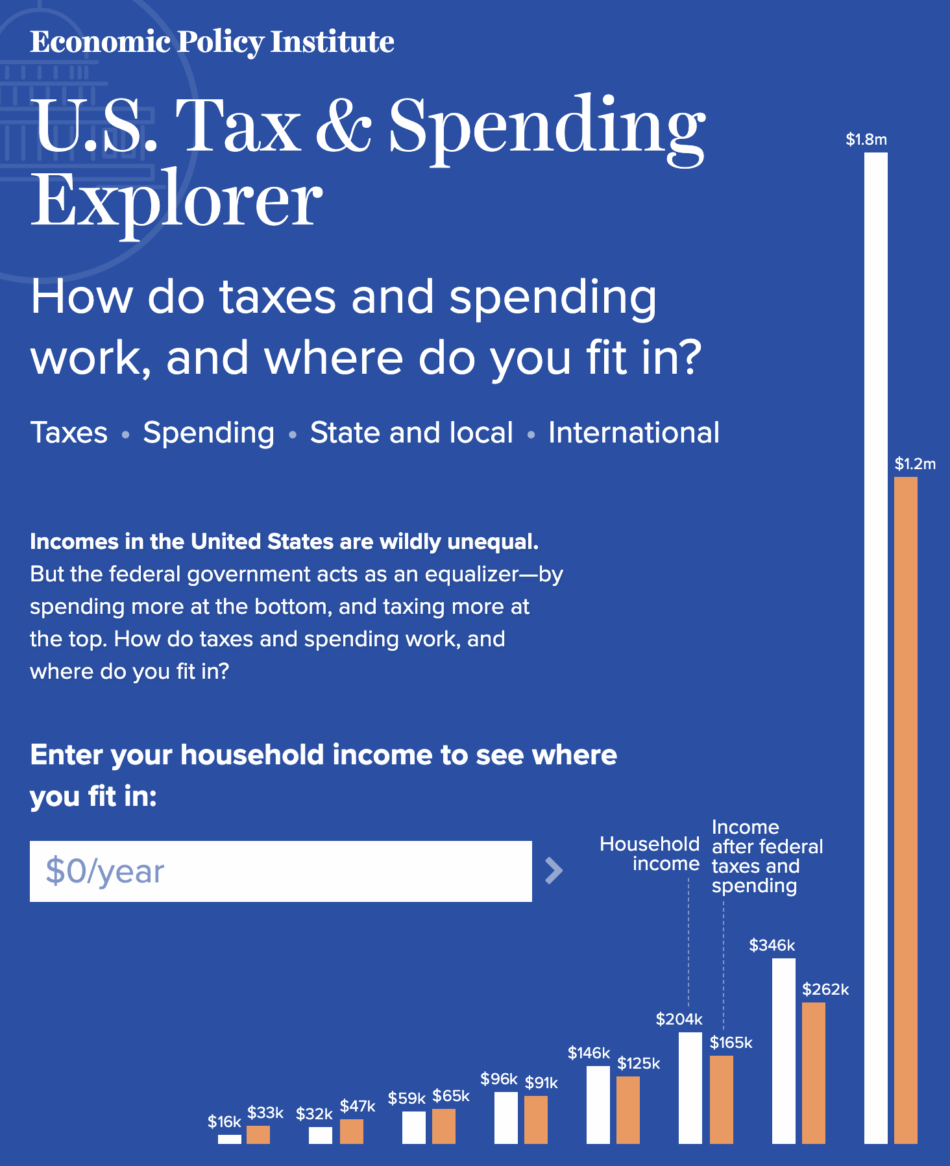

The U S Federal Tax And Spending System Is The Biggest Tool To Combat Inequality But It Could Do Much More Economic Policy Institute

The Best Tool For Tax Planning Physician On Fire

New Jersey Nj Tax Rate H R Block

The Best Tool For Tax Planning Physician On Fire

10 An Hour Is How Much A Year Before And After Taxes The Next Gen Business

28 000 After Tax 2021 Income Tax Uk

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

New Mexico Paycheck Calculator Smartasset

Florida Tax Free Weeks In 2022 Mycentralfloridafamily Com

People Always Say That After A Certain Point It S Not Worth Working Overtime Anymore Because Of The Higher Tax Bracket You Re Put In Is This True Quora